A recent analysis from 1stOncology/BioSeeker reveals the direction of commercial drug development emerging from the European Society of Medical Oncology (ESMO) (Free ESMO Whitepaper) 2018 congress, featuring more than 2000 abstracts detailing the latest ground-breaking science/clinical development in oncology.

Schedule your 30 min Free 1stOncology Demo!

Discover why more than 1,500 members use 1stOncology™ to excel in:

Early/Late Stage Pipeline Development - Target Scouting - Clinical Biomarkers - Indication Selection & Expansion - BD&L Contacts - Conference Reports - Combinatorial Drug Settings - Companion Diagnostics - Drug Repositioning - First-in-class Analysis - Competitive Analysis - Deals & Licensing

Schedule Your 30 min Free Demo!

While this analysis tells you all from which immunotherapies are dominating at E.S.M.O to development of novel targets, never previously pursued in oncology, the center stage for the “Commercial Interest at E.S.M.O Annual Meeting 2018” is to feature where E.S.M.O makes a footprint in the commercial cancer drug development landscape. What’s so compelling with the analysis is that is constructed from an exceedingly solid knowledge-base of more than 12,500 drugs, 4,000 companies/organizations and tens of thousands of interventional clinical trials in oncology.

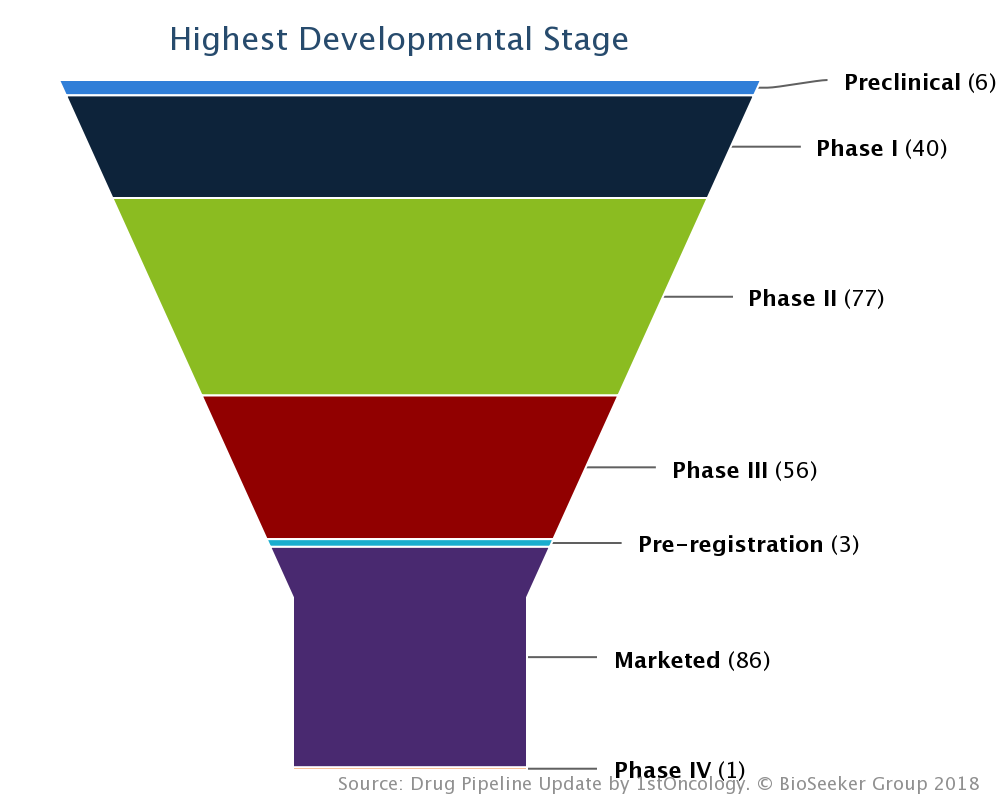

The hotbed of this conference is energized from an underlying cluster of roughly 300 drugs ranging from preclinical to marketed in maturity (see pipeline breakdown by stage above). Two fifths (40%) of these are Immune-Oncology drugs including Immune Checkpoint drugs, Cancer vaccines, Bispecific immunomodulators, CAR/TCR therapies and Oncolytic virotherapies. In the spotlight of this year’s Nobel Prize in Physiology or Medicine E.S.M.O 2018 features nearly 40 different immune checkpoint drugs, by far the most reported on immunotherapy and even more so if we take into account all combination therapy reports with the same. Other hot progress areas in cancer therapeutics include DNA Damage Response (DDR) drugs, epigenetic therapies, protein kinase inhibitors and antibody-drug conjugates (ADCs).

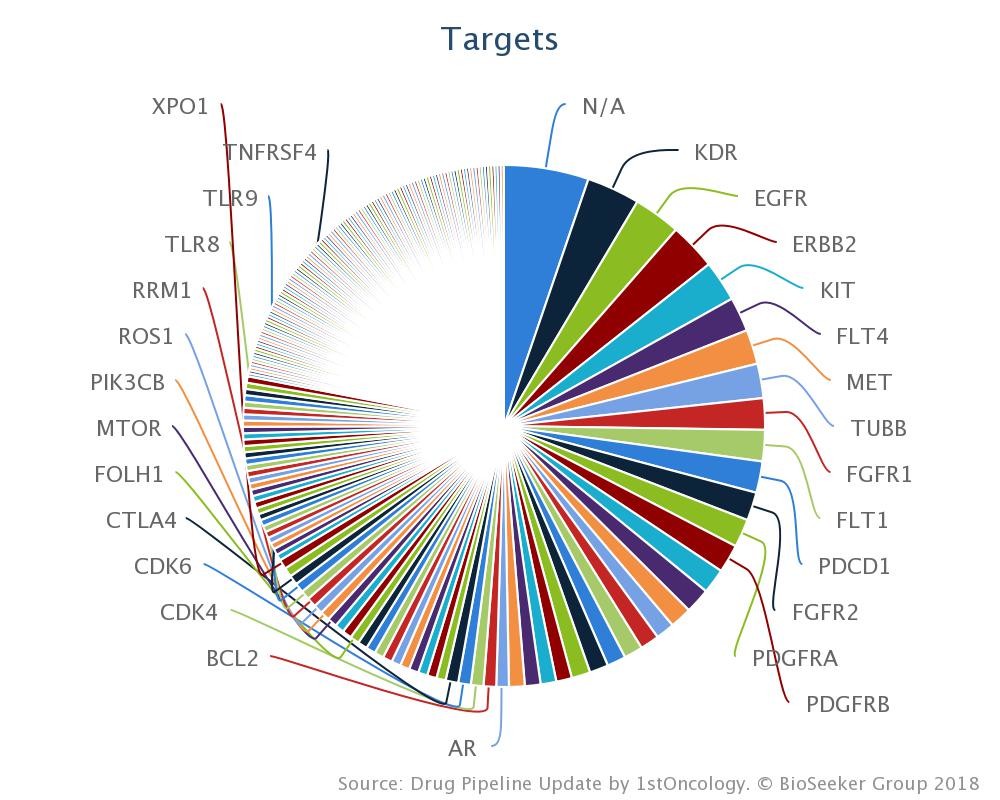

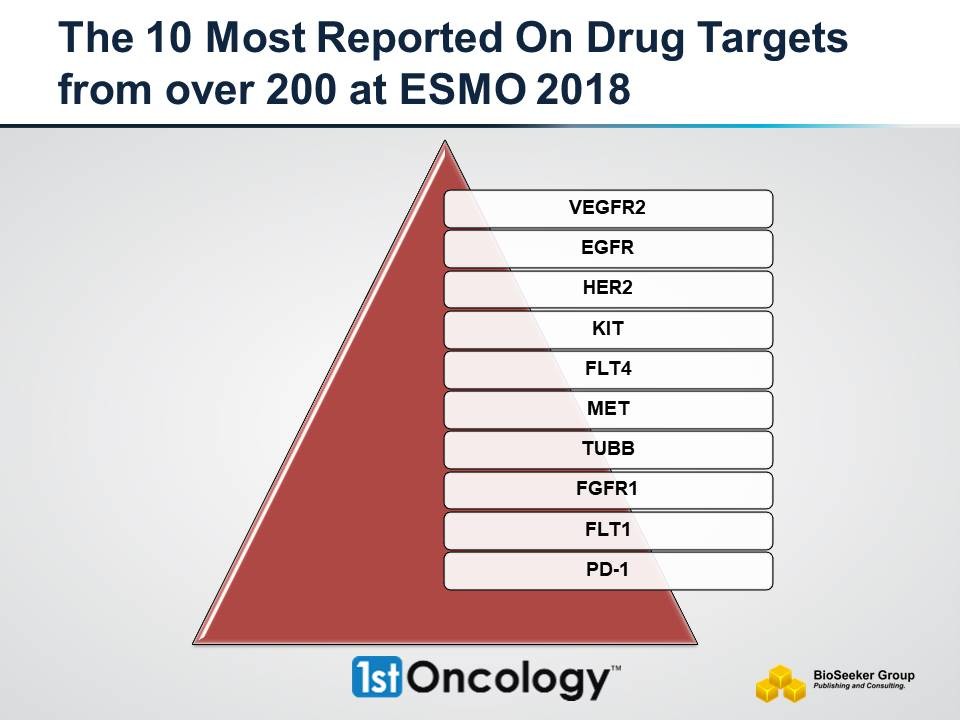

The number of targets related to the aforementioned drugs is close to 200 were the top five drug targets are: KDR/VEGFR2 (17), EGFR (15), HER2 (14), KIT (13) and FLT4 (11) (see target breakdown above).

On the contrasting end of these we find fourteen unique targets belonging to first-in-class drugs like Astellas’ enfortumab vedotin, a fully humanized monoclonal antibody that delivers the microtubule-disrupting agent monomethyl auristatin E to tumors expressing Nectin-4, which is highly expressed in 97% of metastatic urothelial cancer patient samples.

There is a global presence of companies at E.S.M.O 2018 ranging from big pharma to startups like Arcus Biosciences (USA), CStone Pharmaceuticals (China), Neon Therapeutics (USA), NEOMED Therapeutics 1 (Canada) and Oblique Therapeutics (Sweden).

It is noteworthy to mention that both Arcus Biosciences and Neon Therapeutics are 2016 winners of the prestigious Fierce 15 Biotech award (see 2018 cancer winners here). This prestigious award has come to symbolize novelty and being at the forefront of biotechnology development among businesses. The winners of this award are aiming at breakthroughs and big things, not at being ‘me-too’. For an example Arcus Biosciences is reporting stellar safety data from its phase 1 study of AB928, a dual antagonist of the A2aR and A2bR adenosine receptors. This development is of course only the tip of the iceberg of clinical trial reports presented at this year’s conference. In a late breaking abstract (LBA) Friday (October 19) Merrimack Pharmaceuticals will be providing more information to their previous report in June about their failed CARRIE study, evaluating the addition of istiratumab (MM-141) to standard-of-care treatment in patients with previously untreated metastatic pancreatic cancer and high serum levels of free Insulin-like Growth Factor-1 (For more LBAs see Saturday, Sunday and Monday releases). The study did not meet its primary or secondary efficacy endpoints in patients who received istiratumab in combination with nab-paclitaxel and gemcitabine, compared to nab-paclitaxel and gemcitabine alone. These results were consistent in all subgroups analyzed.

In overall the late breaking abstracts presented at ESMO (Free ESMO Whitepaper) 2018 are testament to years of rapid growth of and interest in combination therapy trials and in particular with immune-checkpoint inhibitors. On Saturday (October 20th) Genentech/Hoffman-La Roche got the world’s attention with “game changing” results from their IMpassion130 study, a global, randomised, double-blind, phase 3 study of atezolizumab + nab-paclitaxel versus placebo + nab-paclitaxel in treatment-naive, locally advanced or metastatic triple-negative breast cancer (mTNBC). Among those who received the combination, the median survival was 21.3 months, compared with 17.6 months for those who received chemotherapy alone. The difference was not statistically significant. However, looking only at women with positive PD-L1 expressing tumors the median survival was 25 months in the combination group, versus 15.5 months with just chemotherapy. That finding has however not been analyzed statistically, and the patients are still being followed. These finds were simultaneously published in View Source">The New England Journal of Medicine and presented at ESMO 2018.

In spite of limited representation of a major therapeutic class like CAR/TCR therapies or the latest progress on targeting the CD47-SIRPA axis, all in all the ESMO (Free ESMO Whitepaper) congress is Europe’s largest clinical oncology meeting and a go-to place that acts as a sign-post on the road ahead in cancer drug development.